company tax rate 2019 malaysia

Resident SMEs SMEs are companies with paid up share capital of less. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here.

Gender Equality Korea Has Come A Long Way But There Is More Work To Do

The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Korean summary of investment and tax information prepared and developed by Deloitte Malaysia.

. Small and medium companies are subject to a 17 tax rate with. Rate TaxRM A. A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. On the First 5000. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent.

The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Chinese summary of investment and tax information prepared and developed by Deloitte Malaysia. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding. On the First 20000 Next 15000.

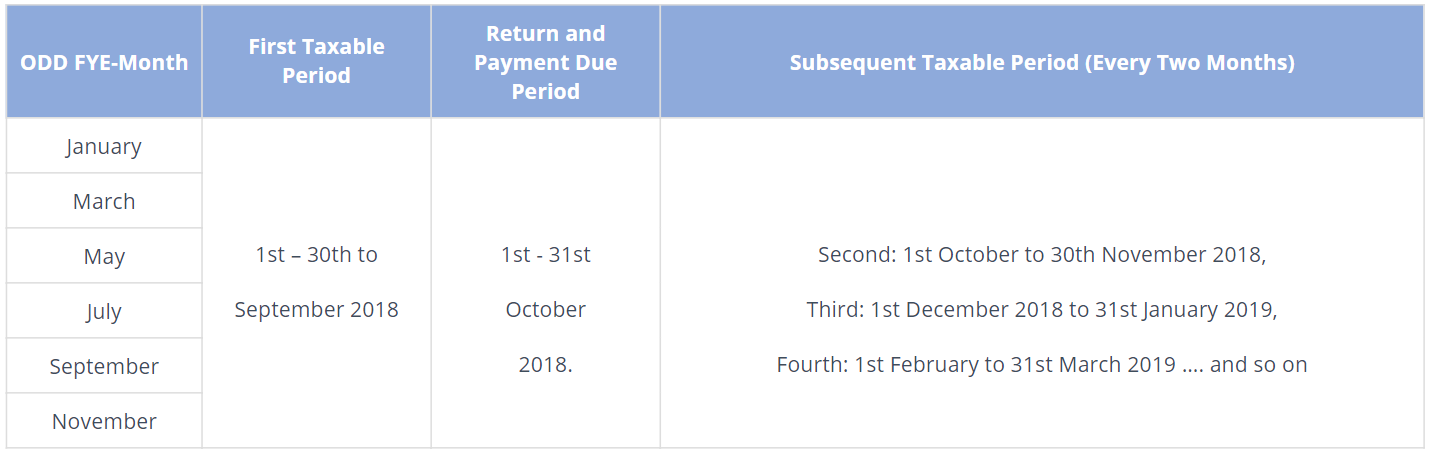

As part of the employers responsibility a company with employees will need to retain a percentage of the employees remuneration including salary commission bonus incentives. What supplies are liable to the standard rate. On the First 5000 Next 15000.

The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Company with paid up capital not more than RM25 million On first RM600000.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50. 22 October 2019. Malaysia Residents Income Tax Tables in 2019.

An effective petroleum income tax rate of 25 applies on income from. To encourage more investors and businesses to set up in Malaysia the government has initiated a few tax incentives. Income tax rates.

10 percent for Sales Tax and 6 percent for Service Tax. The standard Malaysia corporate tax rate is of 24 for the financial. For Sales Tax goods other than petroleum products which are not.

Contract payments to non-resident contractors in respect of services under a contract project are subject to a 13 deduction of tax 10 on account of the contractors tax. Company with paid up capital more than RM25 million.

Gender Equality Korea Has Come A Long Way But There Is More Work To Do

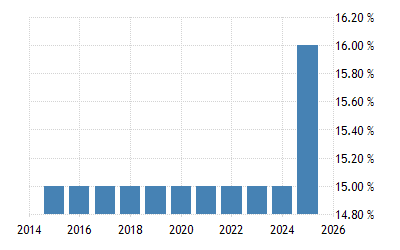

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Company Tax Rates 2022 Atotaxrates Info

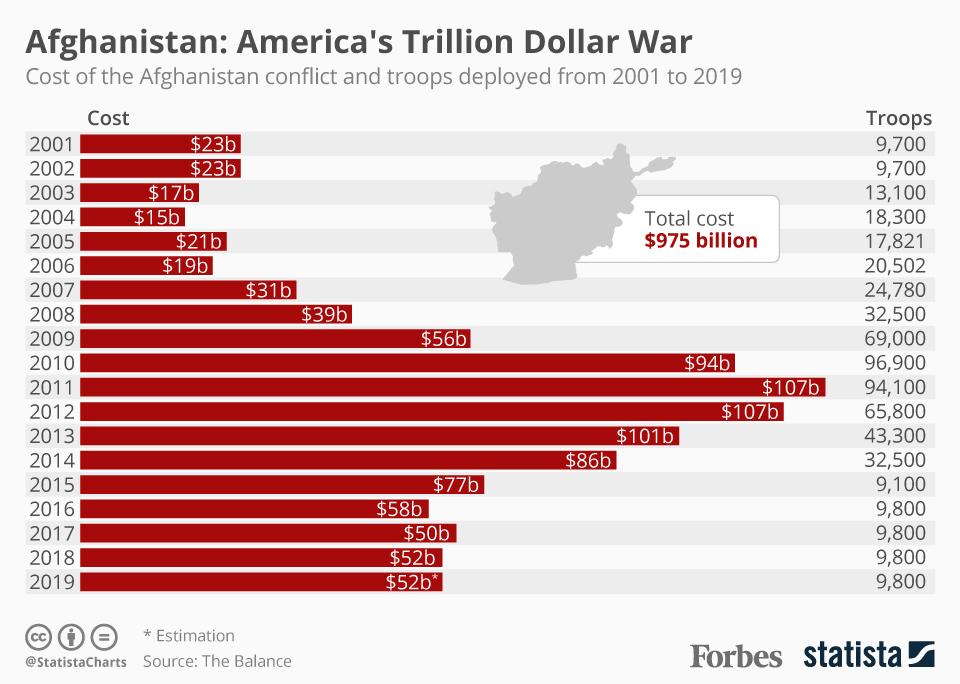

The Annual Cost Of The War In Afghanistan Since 2001 Infographic

:max_bytes(150000):strip_icc()/3MWord-c3d696cde10640509f532aaa5e36791d.jpg)

The Difference Between Record Date And Payable Date

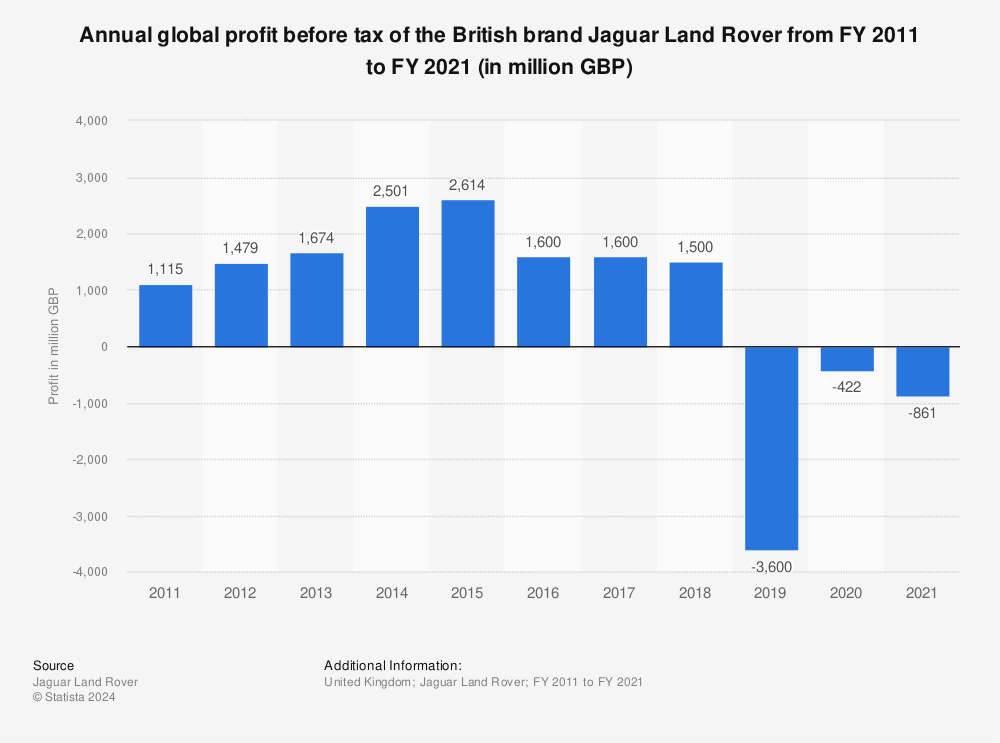

Jaguar Land Rover Profit Before Tax 2011 2021 Statista

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

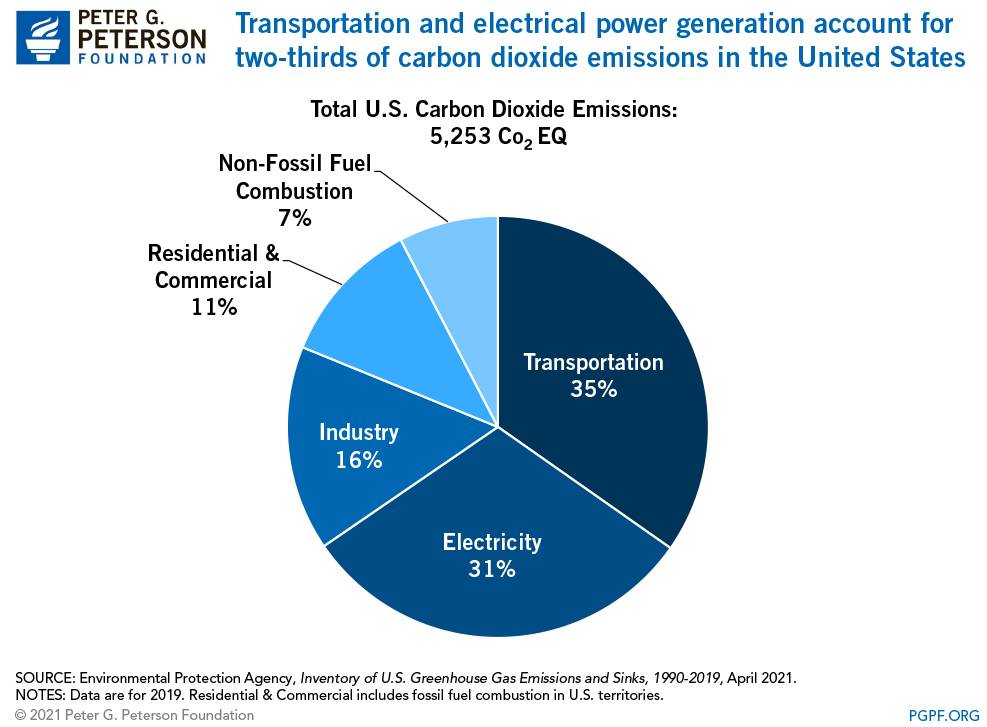

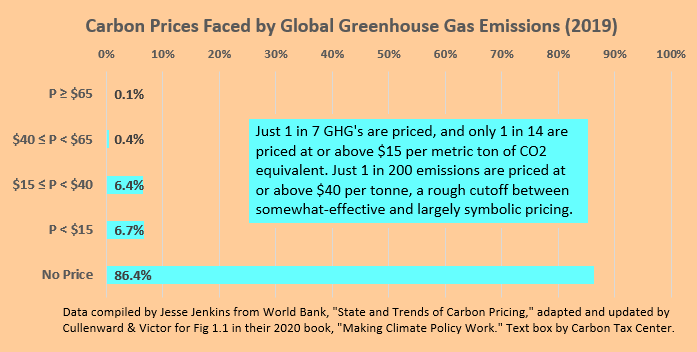

What Is A Carbon Tax How Would It Affect The Economy

How Much Does A Small Business Pay In Taxes

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

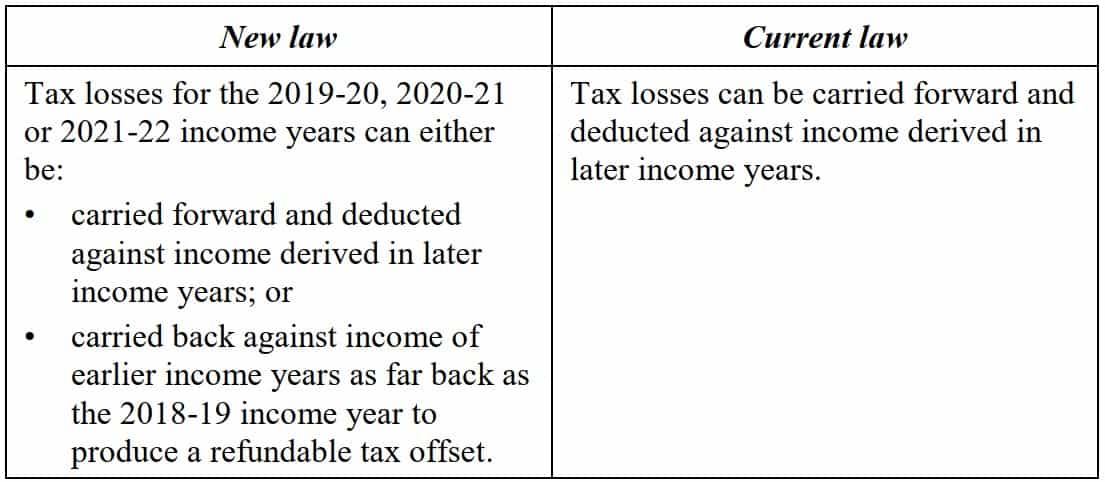

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

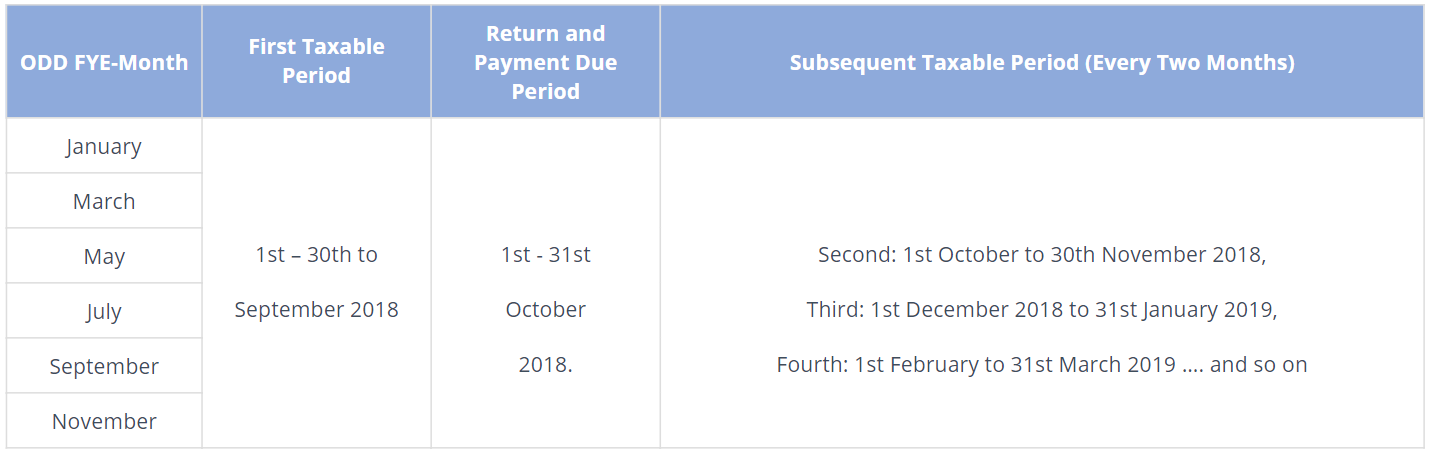

Malaysia Sst Sales And Service Tax A Complete Guide

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com Investing Property Investor Investment Property

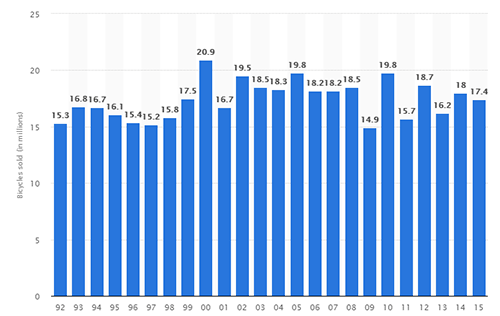

Bike Statistics And Facts 2019 Pioneer Sports

Renewable Energy Prices Hit Record Lows How Can Utilities Benefit From Unstoppable Solar And Wind

Income Tax Malaysia 2018 Mypf My

How Much Does The Federal Government Spend On Health Care Tax Policy Center

Where Carbon Is Taxed Overview

2019 Q4 And Full Year Results Presentation Transcript Novartis

Comments

Post a Comment